Oh I think it’s pretty exciting… more like waiting for an explosion rather than darkness. ![]()

I sold all of my US stocks today. I know this isn’t a Clark-ism, and I don’t recommend it for everyone, but I’m an experienced technical trader, and have gotten good results over many years, so… yeah. It’s winter time again.

But my message to non-traders is this… if you’ve been startled by the stock market so far, since 12/31/2024, that’s a sign you have too risky a portfolio, because we’ve barely begun if this is truly going to be a bear market. The S&P500 is only down -4.87%. In a real bear market it gets cut in half.

You must take diversification very seriously. The S&P500 (SPY VOO IVV SWPXX FXAIX) isn’t diversified just because it has 500 companies in it. It is highly skewed toward mega-cap tech stocks. You do not own 500 equal sized slices. You have 7% in Apple, 6% Microsoft, 6% NVIDIA, 4% Amazon, 4% Alphabet Classes A & C, 3% Meta, 2% Berkshire Hathaway, 2% Broadcom, 2% Tesla, etc. If you want 500 absolutely equal slices… buy RSP.

Also S&P500 is one country, the USA. One country does not dominate forever and ever. Every market goes in and out of favor. Japan peaked in the late 1980s and was down for 30 or 40 YEARS. It’s not beyond possibility that we have another Lost Decade in the USA. It has happened before, usually around the time Americans are most confident (arrogant?) that the USA will always be on top. We’re talking 1929, late 1960s, 2000. Those epochs ended in tears, and usually bad behaviors cropped up and people sold at or close to the bottom. Because they got psychologically broken.

If you’ve been having heartburn since 12/31/2024, here are what asset classes other than S&P500 have done during that 12/31/2024-3/28/2025

Gold (GLD) +17.32%

ex-US stocks (VEU) +6.61%

Bonds (AGG) +2.54%

S&P500 (VOO) -4.87%

NASDAQ100 (QQQ) -8.14%

Note about gold… Clark used to recommend no more than 10%, now he recommends no more than 5%. Honestly, I think 10% is better. 5% doesn’t move the needle.

I suggest everyone own everything and sleep well at night, and if you can’t figure out what to own, get a target date fund and forget about it. Let the fund managers worry about rebalancing and glide path management. Or, if it were me, target date fund 90%, GLD 10%.

There isn’t a cause of stagflation. There is a cause for inflation and a cause for recession.

These days recessions are mostly caused by belt-tightening when consumer indebtedness gets too high. Gone are the inventory recessions so prevalent in decades past. Companies manage inventories better than they used to. In the recession of 1958, Ford crushed thousands of brand new, unsold Edsels.

Inflation, on the the other hand, is “always and everywhere a monetary phenomenon”- to quote Milton Friedman. Money supply is increased by monetizing government debt and/or the central bank expanding credit. For the moment we are serious about reigning in government spending by eliminating waste, fraud, and corruption. How long will our religious fervor last?

Of course, if we go into recession, revenues will fall and government expenditures will likely rise, and we might lose the frugality religion.

How much will a government spend? I think it was Bastiat long ago who observed, “All it can manage to collect in taxes and all it can borrow.” There is no limit to the need to buy votes.

If you ever feel bad about the US economy, look into what is happening in China with their debt bubble collapse.

Remember, government data has at least a 2 month lag from reality.

If you were OK during 2007-2008, then you’ll be fine, although it took until 2013 to get the money back. ![]()

My investments in VWENX and Star mutual funds came back in a year.

That may be true… YMMV ![]()

April 2, and another step toward stagflation. ![]()

April 4, and two gigantic steps in that direction. This didn’t have to happen, a completely self-inflicted, possibly fatal wound.

Stagflation requires:

- High inflation

- Zero growth

- High unemployment

Which of those 3 do we have ?

The Federal Reserve Bank of Atlanta’s GDPNow real-time GDP “speedometer” if you will, is showing negative GDP growth, although this measurement is extremely noisy.

We don’t have high unemployment. But unemployment is known as a lagging indicator. Usually when unemployment reaches a high point, the recession is “beginning to end”.

We don’t have high inflation, in fact, over the past two days, the 5-year TIPS breakeven inflation rate has collapsed to 2.4%. Before we cheer, however, be careful what you wish for… this may be collapsing because the bond market is sniffing out a slowdown.

I think we really have to wait a couple of quarters before we see where we are. I think slowdown is inevitable, and Bank of America is now calling a 60% recession risk in 2025.

I still don’t know if this all causes inflation or deflation. Honestly, I think it initially spikes inflation, but then consumers and businesses are so harmed by it that they go into “turtle” mode and try to wait it out on large purchases and capital investments until 1/20/2029. That’s my mentality… be happy with what I have, make do, and and wait for the tariffs to go away.

The McKinley tariffs went away. Smoot-Hawley tariffs went away. We try this every hundred years, they fail, we give up are having been greviously harmed as a Nation, everyone who remembered them dies, then a new generation starts running with scissors again. Ask me on July 4th.

HEARD AT WORK… tariffs are going to add millions of Dollars to each of our sales, and we don’t know if our customers, major oil exploration & production companies, will accept those or buy less, or not buy at all, or if we have to fully or partially eat the tariff. MY EMPLOYER WILL PAY TARIFFS TO THE US GOVERNMENT.

We have US and International customers. For the International customers, it looks like the Asian computer components will land in Monterrey Mexico, the supercomputing applicance racks will get assembled there, then we will ship from Mexico to worldwide, except not to the US. US destination products we would assemble in Houston, which we have done in the past.

Also, we could place our appliance in data centers in Canada or Mexico, and then our new USA customers would log in to the supercomputing applicance remotely (it’s remote anyway… this is just somewhat longer distance) so we avoid tariffs altogether? This will take away business from Houston data centers.

I know everyone thinks Mexico is just tumbleweeds, burros, and narcos.. .but our Monterrey contractor does a great job.

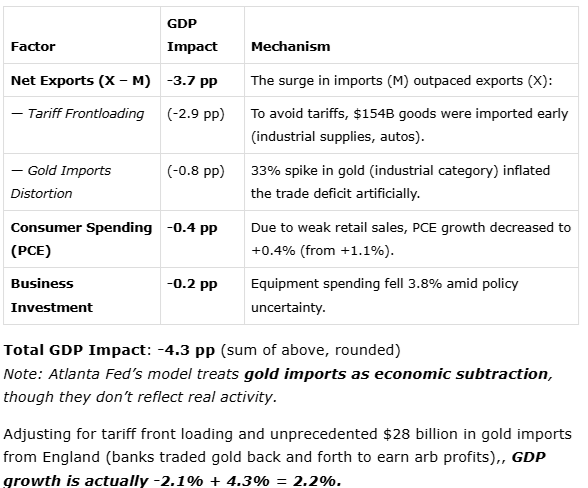

The GDPNow number reflects what is actually happening now (not a forecast) and is jaded when one-time events happen. The threat of tariffs caused a significant front-loading of imports and a significant increase of Gold imports that count as a negative toward GDP. Here is a detailed writeup I found somewhere:

Additional references about how GDPNow is calculated:

Look at GDPnow, they also present a “gold corrected” nowcast. It’s still negative. But yes, front-running tariffs decreases GDP. We shall see. The figures going forward should be more accurate because front-running is over.

One more step toward stagflation:

Inflation continues to remain in check…actually negative last month at the wholesale level…

[quote=“butler, post:35, topic:7249”]

Inflation continues to remain in check…

[/quote]Mostly due to price of crude. Consumers will probably not see that at the pump.

Lately I have been reading about the downturn in China. It is hard to understate how shaky things are for the average Chinese worker. China has a 1.3 billion population or thereabouts. Any slowdown there would decrease demand for petroleum significantly.

I don’t know why there is so much fear mongering about inflation when it is decreasing.

You can make a good argument for recession, in fact I think one started EARLY January. But I see no reason to fear over a resurgence in inflation.

Gold has gone above $3200 an ounce, and Treasury yields are rising. What might that tell you?

Central banks are buying gold rather than US debt issues to bolster their reserves.

$3270 just now